Why I Give

Support

If you would like to learn more about legacy gifts, bequests, charitable gift annuities, charitable lead and charitable remainder trusts, and other methods of including Mystic Seaport in your estate plans, please contact the Advancement office at 860.572.5365 or email chris.freeman@mysticseaport.org/.

An Easy Way to Get Started

In partnership with FreeWill, Mystic Seaport supporters can use a new, online tool to write a legal will for free, and include the necessary language to create a legacy gift in their plans. This tool is safe and secure, and can be used with an attorney for more complex estates. Click here to get started.

Mystic Seaport thanks you for your support.

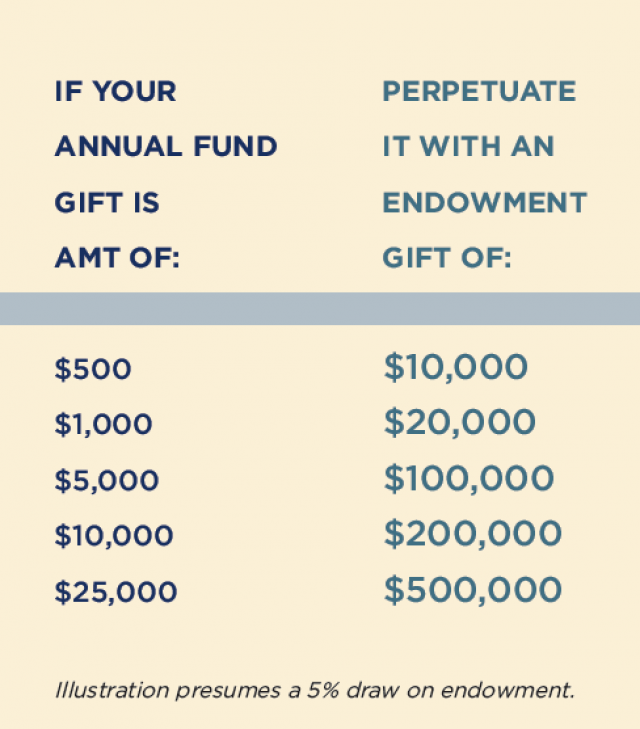

Perpetuate Your Annual Fund Gift To Mystic Seaport through a bequest gift to the general endowment

Legacy Bulletins